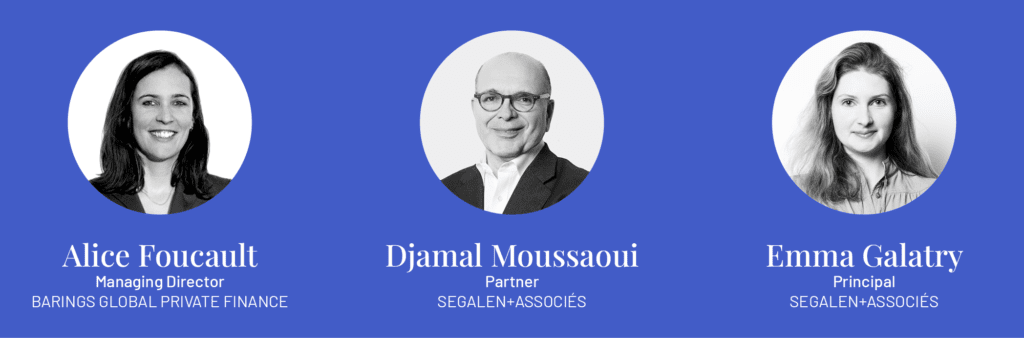

With Private Debt expected to outperform… 3 questions to Alice Foucault, Managing Director at Barings Global Private Finance

Meet Alice Foucault – Senior member of Barings’ Global Private Finance Group (“Barings”) and a member of the European Private Finance Investment Committee. As a Managing Director, she is responsible for originating, analysing, structuring and monitoring European private finance investments. As a native French speaker, she has a focus on the French market but also looks at opportunities outside of France.

Barings Private Finance is a leading player in the mid-market segment and reputed for its high-quality pipeline, strong conversion rate and resilient portfolio. In this edition of “3 questions to…”, we explore how Barings stays competitive in an evolving European environment and Alice’s views on latest macro trends, ESG and talent recruiting.

How does Barings differentiate itself in a competitive mid-market environment – from being a simple debt provider to a strategic partner for sponsors?

The marketplace has undergone significant transformations over the past 12-18 months. There has been a slowdown in M&A activity however at the same time the capacity available to finance mid-market transactions has also reduced driven by two factors: i) limited capacity from some debt funds after a high level of deployment in 2021/2022 and ii) a drift in size from some direct lenders moving to the large cap space to fill in the lack of liquidity from the BSL market – in that respect we have seen large club of unitranche lenders to finance large cap deals.

By staying focused on mid-market deals, we at Barings typically remain a sole lender and develop close relationships with our key sponsors and management teams. Several factors set us apart:

-

A distinct market positioning: sponsors know precisely when to engage with Barings and the specific types of deals we are capable of executing. Although securing financing was more straightforward two years ago, we have managed to keep our reputation of consistent delivery at competitive terms.

-

Efficient and proactive decision-making: we can swiftly evaluate and prioritize among a multitude of transactions. Our communication channels are short and efficient, known for their ease and speed by counterparties. Our European “pre-committee”, comprising three senior investment professionals, effectively screens opportunities, providing confidence that when we submit an offer, it means commitment and subsequent delivery. This pre-validation method has proven to be a success. Senior team members also maintain a hands-on approach when engaging with management teams – an important factor in persuading them to opt for an unitranche product over conventional bank financing.

-

Breadth of operations, scale and flexible investment approach: with approximately $45bn in global debt commitments, our platform is expansive and allows us to leverage resources effectively. Over the past decade, Barings transitioned from being a mezzanine provider to deploying its balance sheet money (operating as a subsidiary of the MassMutual Financial Group) to facilitate various Direct Lending solutions. We then started raising third-party capital, with the goal of becoming a sole lender. Our positioning, coupled with our appetite for buy-and-build situations, enable us to foster close relationships with private equity funds and generate recurring business. Nearly half of our annual deal flow comes from follow-on investments to support build-ups. Lastly, our “senior stretch” bridges the gap between unitranche and senior bank financing, allowing us to capture additional market share.

-

A robust and diverse investment team: our team shows stability, with Managing Directors and Directors working together for 7 years plus. Our investment strategy is well understood by all team members. Prioritising a multicultural and diverse team in terms of genders, profiles and backgrounds is central to us. We now adopt a more thoughtful approach to diversity recognising its significance. Having a positive and healthy internal culture has made a difference internally and in interacting with sponsors. I believe it is one of our key strengths and a differentiator in the way we do business and recruit talent.

Then, it is a virtuous circle. Our track record speaks for itself. In France, we consistently rank among the top 3 lenders. With €2bn deployed in 2022, it represents our second-largest European market in terms of assets under management and deal volume. We consciously chose not to be exclusively Paris-based, prioritising a “one-team” culture in London. We have successfully built a credible local reputation. Sponsors find this cross-border approach valuable for leveraging and comparing Barings Private Finance’s pan-European expertise.

Has your investment philosophy been adjusted in response to the changing macro-economic environment?

Not particularly. We have always invested in transactions thinking there would be an economic downturn just after. We run highly diversified funds by number of transactions/geographies/sectors, with a focus on businesses with good margins and high cash conversion. In a complex macro-environment, we also typically structure our deals with a high equity component (~60%+) to provide downside protection.

An obvious consequence of increasing interest rates has been the impact on portfolio companies’ ability to manage liquidity, as financing costs have nearly doubled. We track this closely as part of our reporting.

When it comes to our ability to handle workout scenarios – which is one of our investors’ first concerns – we are fortunate to have team members with prior restructuring experience. We have agreed on more frequent discussions and committees to proactively address potential challenges. Our specialised Distressed team is also a key support group with a complementary skillset to guide us. Given our role as sole lender, having an ongoing dialogue with sponsors makes a difference and our investment mindset distinguishes us from conventional banks. We understand each other and each party is committed to putting in the necessary effort: we see ourselves as a real partner, and not just a provider of debt financing. This is also the attractive aspect of mid-market loans, we benefit from maintenance covenants on all our transactions which allow us to address potential underperformances early on.