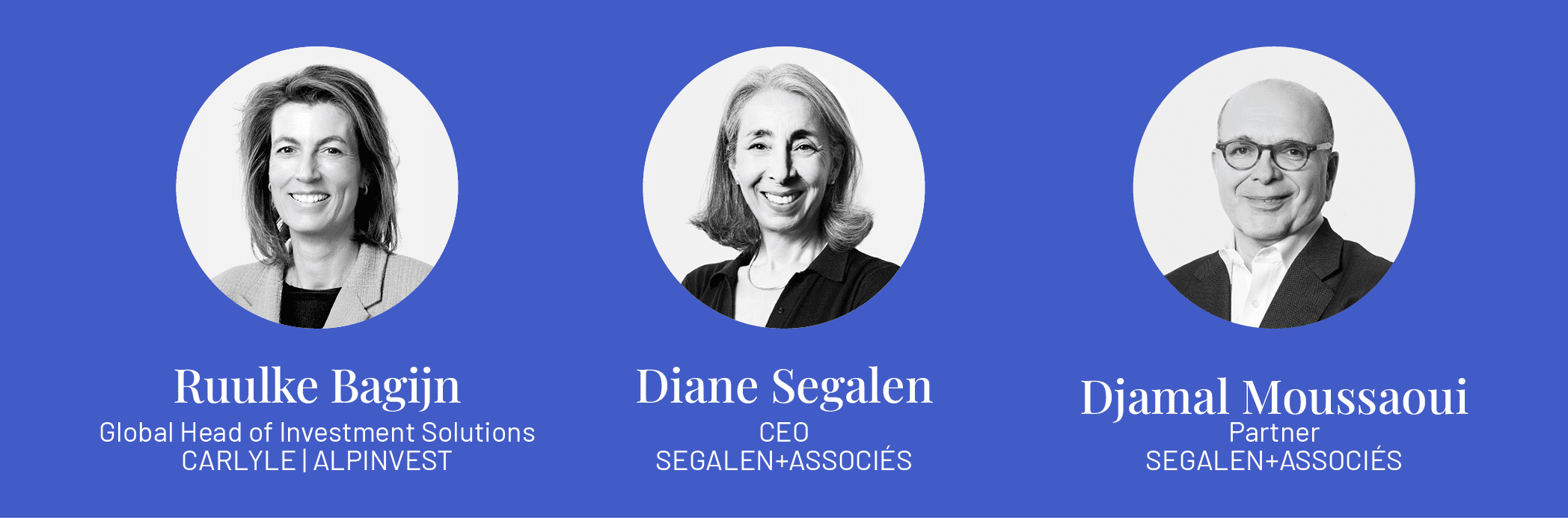

“Diversity is an attribute of excellence in decision making”, 3 questions to Ruulke Bagijn, Chair of the Board of AlpInvest – The Carlyle Group

09/07/2024

Marketing et Project Manager

Alina a rejoint SEGALEN+ASSOCIES en tant que chef de projet et responsable marketing, supervisant la gestion des missions à Paris et à Londres. Elle est également responsable des activités marketing du cabinet, notamment de son site web et de sa présence sur les réseaux sociaux.

Elle est titulaire d’un master en journalisme international de l’Université russe des sciences humaines, où elle a également obtenu sa licence en journalisme. Avant de rejoindre SEGALEN+ASSOCIES, elle a passé plus de cinq ans à l’Institute of Certified Bookkeepers, où elle a établi des partenariats internationaux, organisé des événements et joué un rôle clé dans la croissance commerciale de l’organisation. Au début de sa carrière, elle a acquis de l’expérience dans la vente et la traduction. Trilingue, elle apporte une perspective internationale à son travail.

Chez SEGALEN+ASSOCIES, elle veille au bon déroulement des missions tout en pilotant la stratégie de visibilité et de communication du cabinet.

En dehors du travail, elle aime passer ses week-ends dans les musées ou profiter de la nature. Elle s’intéresse beaucoup au développement personnel, à la psychologie, à l’art et aime courir.